The funds will help Vodafone India to continue its investments in spectrum and expansion of networks to improve customer satisfaction

By Kalpana Pathak | Sep 23 2016 | Mumbai

Vodafone India Ltd said it has received an equity infusion of Rs47,700 crore ($7 billion) from its parent Vodafone Group Plc. that will help it buy more spectrum, expand infrastructure, reduce debt, capitalize a proposed payments bank and improve service quality.

“This equity infusion will be used for right-sizing our spectrum portfolio, expansion of technology across our multiple technology layers and deployment of future next-generation 4G and 5G technology,” said Sunil Sood, managing director and chief executive officer, Vodafone India.

Vodafone is infusing the money at a time when India is preparing for its largest auction of telecom radio waves on 1 October and in the background of an aggressive launch by Reliance Jio Infocomm Ltd, the telecom unit of Reliance Industries Ltd, that threatens to disrupt the market.

Sood said part of the money will be used to retire the company’s debt, which stands at around Rs25,000 crore. Vodafone also intends to spend some money on improving “quality of service”.

In the first quarter of this financial year, Vodafone, the country’s second largest mobile telephony services provider, gained 0.6% market share and reached a subscriber base of 200 million.

Vodafone is also investing in a payments bank as well as its enterprise business, which Sood identified as areas of future growth. He also said that the company is preparing for a share sale without giving a specific timeline for the initial public offering (IPO).

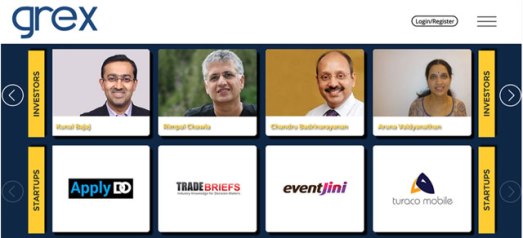

“Vodafone’s equity infusion is definitely inspired by Jio’s entry in the market but it has also happened because Vodafone has been planning for an IPO which got delayed. The funds from the IPO could have been used to support its long-term business plan. Given that the IPO is now delayed, it needed some capital in the interim to make up for that,” said Kunal Bajaj, an independent telecom consultant.

For the spectrum auction, one from which the government hopes to raise Rs5.63 trillion at the base price, the country’s leading telecom operators have deposited Rs14,653 crore as earnest money. Reliance Jio Infocomm Ltd has deposited Rs6,500 crore, said a 19 September PTI report.

Jio, built with an investment of Rs1.35 trillion, is all set to make life tougher for incumbent telcos. The heavy capital spending has helped Jio cover 70% of India with 270,000km of fibre optic cables and 92,000 towers. The company has said it will spend an additional Rs15,000 crore.

Vodafone India has deposited Rs2,740 crore for the auction, Idea Cellular Ltd Rs2,000 crore and Bharti Airtel Ltd Rs1,980 crore. These companies, like Jio, are eligible for bidding in any circle. The earnest money deposit is indicative of a company’s strategy to bid in specific circles and spectrum bands.

The top three telcos– Airtel, Vodafone India and Idea Cellular—purchased adequate spectrum to build capacity in previous auctions over the last five years, and may only look to buy enough in the coming auction to expand their coverage, say some experts. Many telcos have also signed spectrum sharing or trading agreements. Mergers and acquisitions have also reduced the need for additional spectrum.

Still, Jio’s launch may have changed a few things.

Analysts at rating company Crisil Ltd said India’s largest telcos could cumulatively invest about Rs1.2 trillion over the next two years to protect their turf as Reliance Jio debuts. Over 50% of this will be spent on network augmentation and the rest to buy more spectrum and pay instalments for previous purchases, the note said. Airtel, Vodafone and Idea Cellular are expected to account for about 55-60% of the total spending at the auctions, added Crisil

For more information, please click.

The company’s global management recently acknowledged at a conference that Vodafone India needed to strengthen its 4G holdings to be competitive, said a person aware of the matter.

The company’s global management recently acknowledged at a conference that Vodafone India needed to strengthen its 4G holdings to be competitive, said a person aware of the matter.